Essential Guide to PE-Backed CFO Success: Unique Insights from Original Data

Chief Financial Officers (CFOs) within private equity-backed companies operate in a fast-paced, high-stakes environment. They are strategic leaders who can navigate complex challenges while driving growth.

By identifying the key personality traits, value systems, and core competencies that distinguish successful PE-backed CFOs, this groundbreaking research provides PE firms with a valuable tool. This knowledge empowers them to make informed decisions when hiring and developing CFO talent, ultimately leading to a higher chance of success for their portfolio companies.

The following insights are based on unique and valuable talent data collected on the Wisnio platform from 24 private equity-backed CFOs and 595 other C-level leaders in PE-backed companies.

By comparing PE-backed CFOs to other C-level leaders in terms of their competencies, personality traits, and values, it offers a unique perspective on the leadership profile that drives success in this demanding role.

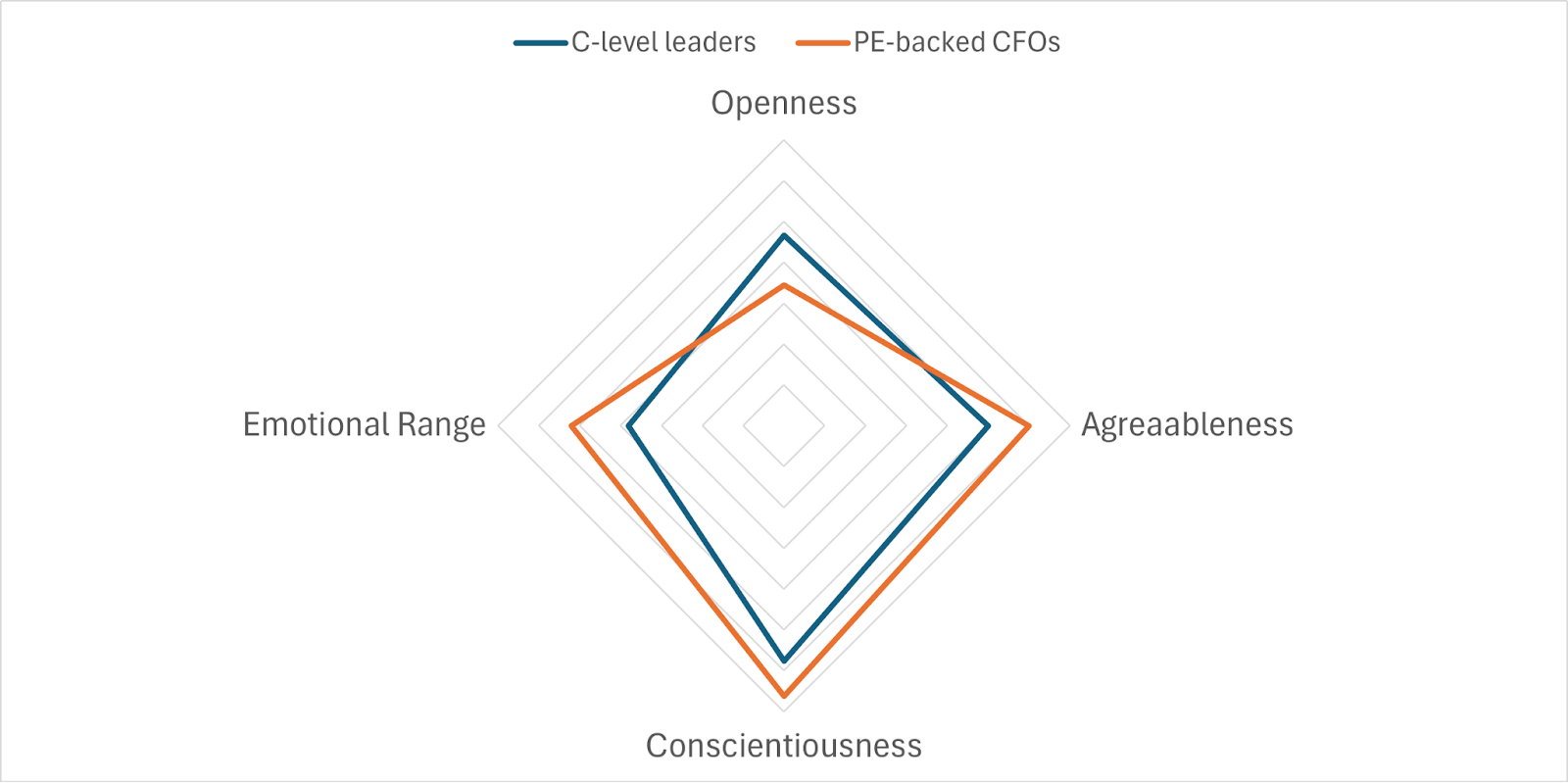

Personality

The Wisnio personality assessment reveals a fascinating profile of a person who excels at navigating the dynamic world of finance, is somewhat more aware of risk and uncertainty (high emotional range) and has a talent for fostering strong team cooperation (high agreeableness). This emotional intelligence is crucial for leading through periods of market volatility and building collaborative relationships within the organisation.

However, a potentially less open approach to new ideas may suggest a preference for established methods. While this meticulousness serves well in risk-averse financial environments, striking a balance with an openness to innovation is critical for long-term success in the ever-evolving financial landscape.

When comparing PE-backed CFOs to other C-level leaders, they demonstrate similar emotional control but may be slightly less receptive to entirely new concepts.

Detailed results

Emotional Range

CFOs show significantly higher scores in emotional range, indicating a higher level of sensitivity to stress or emotional volatility. This could suggest that CFOs experience more stress or have a higher emotional response to stress, which could be linked to the demands and responsibilities of their role.Agreeableness

CFOs score considerably higher in agreeableness, suggesting they are more cooperative, compassionate, and friendly in their interactions. This trait could be advantageous in negotiations, team management, and building professional relationships.Conscientiousness

CFOs demonstrate higher levels of conscientiousness, indicating a strong sense of duty, reliability, and an organised approach to work. This trait is crucial for effective financial management and strategic planning.Openness

CFOs score lower in openness, showing less interest in new experiences and ideas compared to their peers. This could suggest a more conservative or pragmatic approach to risk and innovation, which aligns with the cautious and analytical nature required in financial roles.

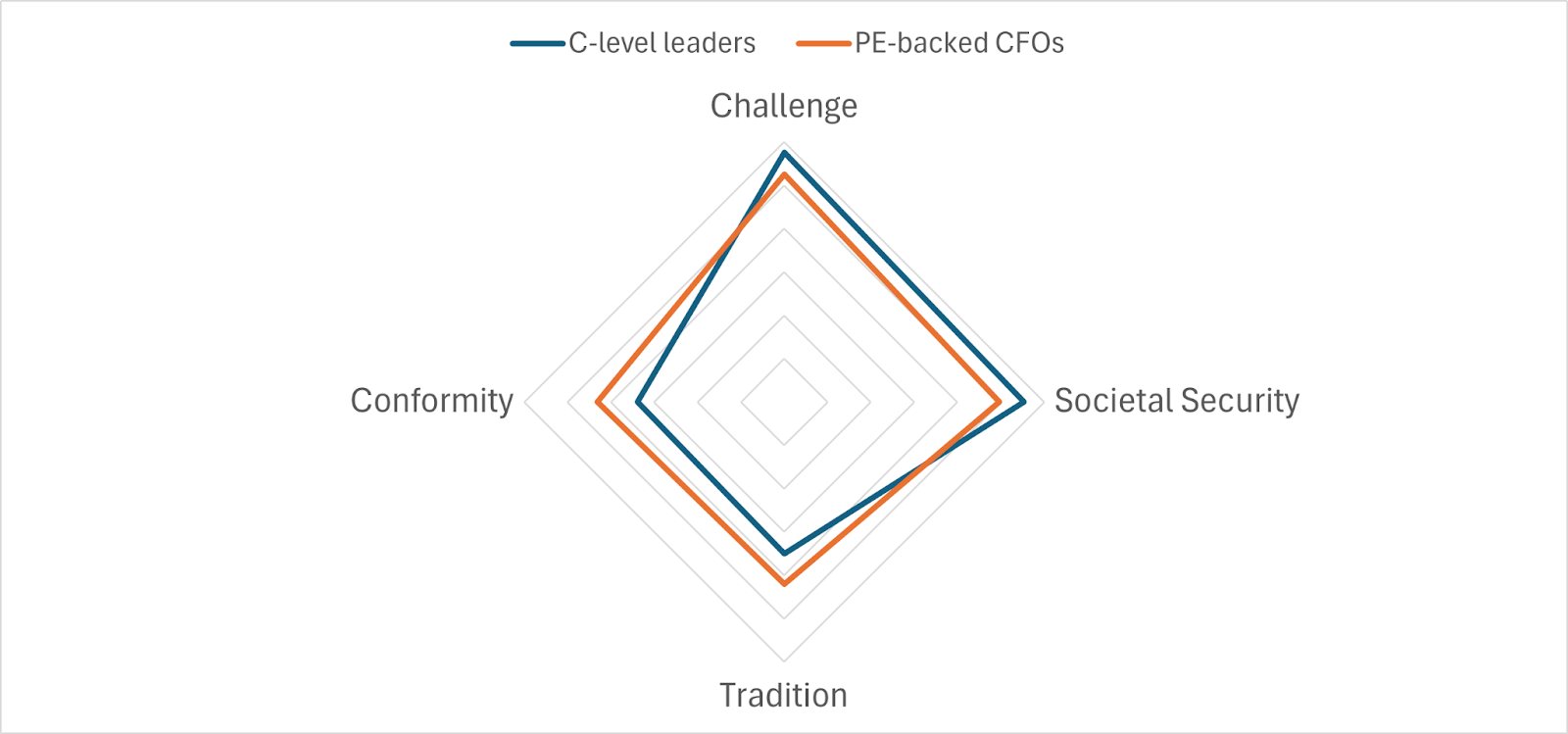

Values

Values serve as the guiding principles for decision-making, and for PE-backed CFOs, a strong emphasis on tradition and adherence to regulations (conformity) is evident. This focus ensures ethical conduct and compliance with established protocols, a cornerstone in the finance industry.

However, the ability to adapt and embrace innovation is becoming increasingly important. Mastering this delicate balance between upholding time-tested practices and navigating the currents of contemporary business demands will be a key challenge for PE-backed CFOs.

Interestingly, PE-backed CFOs place a greater emphasis on tradition compared to other C-level leaders, while still valuing achievement and self-direction to a similar degree.

Detailed results

Challenge

CFOs score lower on valuing challenges, indicating a preference for familiar routines over new challenges, which may align with a risk-averse mindset typical in financial management roles.Societal Security

CFOs also score lower in societal security, suggesting they may place less emphasis on societal stability and security as a guiding value, possibly due to a focus on organisational rather than societal issues.Tradition

CFOs score higher on tradition, which indicates a higher regard for customs and a tendency to follow tried-and-true practices. This can be beneficial for preserving stability and reliability in financial strategies.Conformity

The higher score in conformity for CFOs suggests a stronger adherence to rules, standards, and regulations. This trait is critical in finance to ensure compliance and ethical conduct in financial operations.

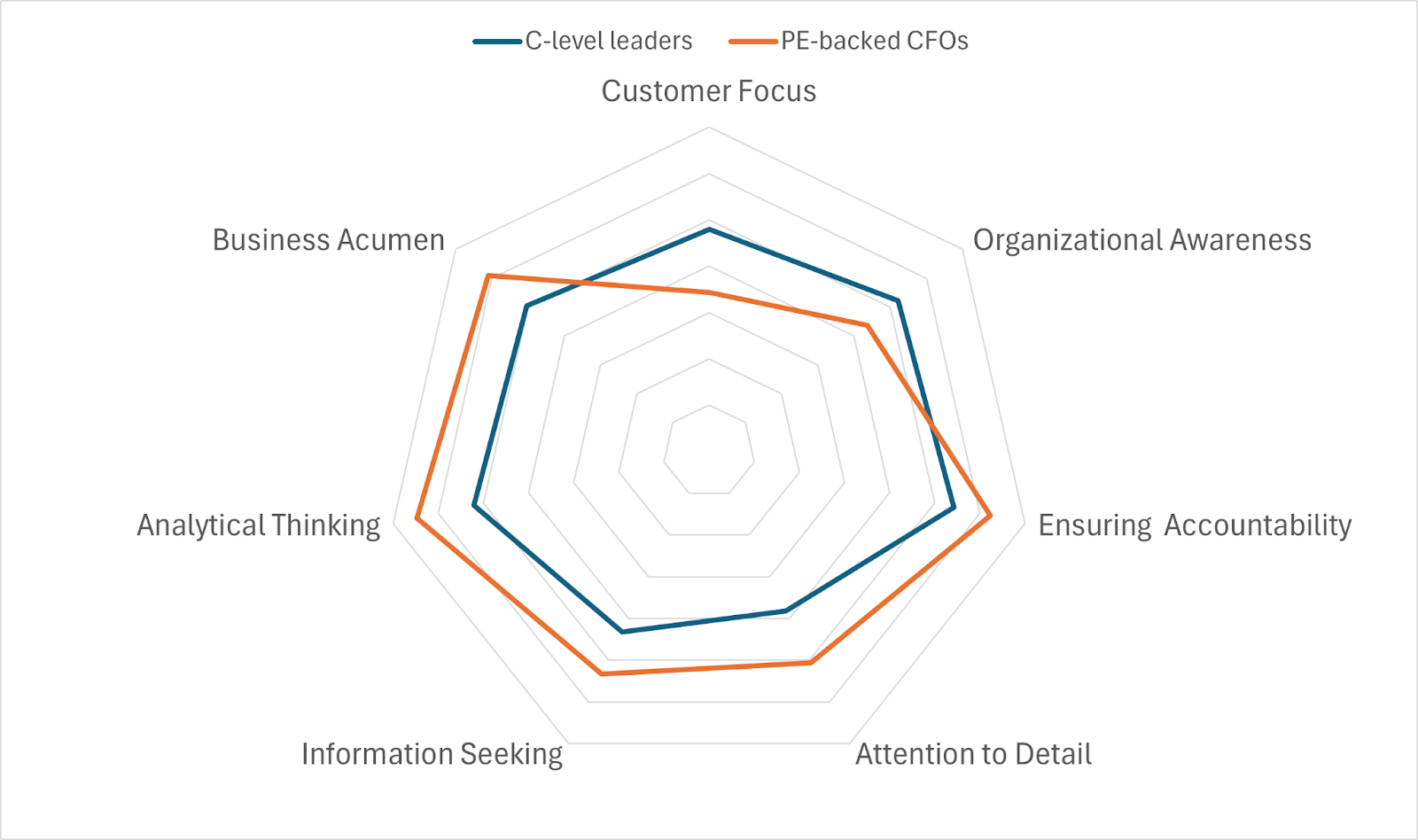

Competencies

The competency evaluation paints a picture of a CFO with a robust skillset. Exceptional analytical thinking, strong business acumen, and meticulous information management form the building blocks of their expertise.

These competencies translate into the ability to construct resilient financial strategies and infrastructures, crucial for navigating the complexities of financial management. As the CFO role expands to encompass strategic influence and innovation, the need to develop organisational awareness and a strong customer focus is becoming increasingly important.

Thus, understanding the intricacies of internal and external stakeholders is key to driving growth and steering towards successful exits for PE firms.

Notably, PE-backed CFOs demonstrate a stronger aptitude for strategic thinking, process improvement, and decision-making compared to their C-level counterparts, while customer focus may require further development.

Detailed results

Analytical Thinking

CFOs score significantly higher in analytical thinking, reflecting their ability to understand complex problems and identify patterns, an essential skill for financial analysis and strategy.Attention to Detail

The higher score in attention to detail shows CFOs' capability to manage information meticulously, a valuable trait for ensuring accuracy in financial reporting.Business Acumen

CFOs display strong business acumen, indicating a deep understanding of the business environment and the ability to apply knowledge effectively, which is crucial for driving financial performance.Information Seeking

CFOs are proactive in seeking information, suggesting thoroughness in research and preparation for informed decision-making.Ensuring Accountability

The competency of ensuring accountability is strong among CFOs, indicating they are effective in setting performance standards and holding individuals and teams accountable.Organisational Awareness

Scoring lower in organisational awareness suggests CFOs may have less understanding of or focus on the internal dynamics and power structures within the organisation.Customer Focus

The lower score in customer focus indicates that CFOs may not prioritise customer needs as highly as other strategic or financial concerns, which could be a reflection of the inward-looking nature of their role.

Conclusions and interview questions

The key findings not only underline the unique position of CFOs within the leadership hierarchy but also highlight specific areas where they excel and where there's room for growth. Each key takeaway below includes behavioural interview questions specifically designed to check for that requirement.

CFOs Tend to be More Risk-Averse

They generally exhibit heightened sensitivity to stress and are more inclined to maintain the status quo rather than pursue new challenges. This cautious approach is likely a reflection of their role in ensuring financial stability.

This is evidenced by higher scores in emotional range and lower inclination for seeking challenges.

Interview question:

Can you describe a time when you had to decide between a safe route and a risky new opportunity? What factors did you consider and what was your decision-making process?

Analytical and Detail-Oriented Decision Makers

CFOs show a strong preference for thorough analysis and comprehensive information gathering, underpinning a methodical decision-making process.

This is evidenced by superior analytical thinking and attention to detail.

Interview question:

Tell me about a complex problem you had to analyse and how you arrived at a solution. What details did you focus on? Alternatively you could ask: Describe an instance where your attention to detail directly impacted the outcome of a financial project.

Collaborative and Responsible Leadership

With higher levels of agreeableness and a commitment to accountability, CFOs demonstrate qualities that foster teamwork and ensure that responsibilities are clearly defined and met.

This is evidenced by elevated agreeableness and strong performance in ensuring accountability.

Interview question:

Give an example of a time when you worked collaboratively to achieve a goal. How did you ensure that all team members were held accountable for their contributions?

Custodians of Corporate Tradition

CFOs have a pronounced respect for established practices and regulatory compliance, which is crucial in their role as financial guardians.

This is evidenced by a higher valuation of tradition and conformity.

Interview question:

How have you balanced the need for innovation with the need to adhere to traditional practices within your organisation?

Areas for Support

In addition to key findings on what PE-backed CFOs are exceptionally strong at doing, there are also a couple of areas where more support is needed. This includes:

Enhancing Customer Engagement

There is room for CFOs to develop a more customer-centric approach, aligning financial strategies with customer needs.

Interview question:

Describe a strategy you implemented that improved customer satisfaction with your company's financial services. What was the result?

Organisational Navigation

Support in understanding and influencing the broader organisational dynamics could further empower CFOs to extend their impact within the company.

Interview question:

Discuss a time when you had to understand and navigate the internal politics of an organisation to get something done. What approach did you take?

For the full hiring guide, check out our free hiring scorecard for PE-backed CFOs.

Methodology

The above insights are based on unique and valuable talent data collected on the Wisnio platform from 24 private equity-backed CFOs and 595 other C-level leaders in PE-backed companies.

The talent data consisted of assessment results from workplace competencies, personality traits, and values, providing a deeper understanding of the specific leadership profile that drives success.

Personality

Wisnio uses the updated IPIP NEO framework of the Big 5 Personality framework*, measuring six facets or dimensions for Extraversion, Conscientiousness, Emotional Range (ER), Agreeableness, and Openness.Values

Adapted from Schwartz's universal values model**, Wisnio's values survey identifies core motivators and attitude-drivers, as well as the type of work environments individuals would thrive in.

- Competencies

Based on Spencer and Spencer (1993)*** research, Wisnio's Competency Survey asks users to select and rank nine out of a total of twenty validated professional competencies.

Discover the power of talent data-driven insights with Wisnio today. Signup is free.

______

* McCrae, R. R., & John, O. P. (1992). An introduction to the five‐factor model and its applications. Journal of personality, 60(2), 175-215.

** Schwartz, S. H., et al. (2012). Refining the Theory of Basic Individual Values. Journal of personality and social psychology.

*** Spencer, L.M., & Spencer, S.M. (1993). “Competence at Work: Model for superior Performance”, Human Resource Development Quarterly Vol. 5, Issue 4, pp 391-395.